Meme Stock

A term used to refer to GME and some other stocks

- The term "meme stock" is somewhat vague and loosely-defined, generally used to mean a stock that trades at valuations disconnected from the fundamental financial metrics of the business

- The term is often used by GME critics as a pejorative to frame GME as an unserious investment

- Pertaining to GME, terms like "meme stock" and "cult stock" are sometimes used in negative contexts as a form of anti-GME FUD

The term "meme stock" operates as a rhetorical device because it frames a stock as unserious, faddish, or irrational from the outset, regardless of its underlying fundamentals.

By invoking associations with internet memes (e.g. humorous but often devoid of substance), the label signals that the market value of the stock is driven by crowds of naive investors without a legitimate investment thesis.

This framing can be used to disparage or delegitimize companies and their stock by implying that their valuation is not grounded in real prospects, thereby preemptively discrediting investors who hold them and shaping public interpretation of market activity.

The vague definition of the term meme stock also enables critics of GME to insinuate that GME is a poor quality investment by associating it with other stocks that have much weaker financials, without referring to GME directly, thus providing a false appearance of impartiality while being biased.

In 2022, the SEC started a game show-themed public service campaign called Investomania, including several videos which were published on YouTube (now removed).

One of these videos, titled: "Investomania: Meme Stocks" which showed a meme stock investor losing all of their money in humiliating fashion.

The SEC did not elaborate on what the term "meme stock" actually refers to, but the message was clear: do not invest in meme stocks or you will lose all of your money and be humiliated.

Per a freedom of information request, it was discovered that the SEC spent approximately $460,000 on the meme stock video.

The release of this meme stock video produced numerous reactions across social media, for example on Reddit:

On October 26, 2022, social media users discussed a Halloween themed post by Fidelity Investments titled "Halloween's Hottest Investor Costumes," providing a characterizing of several different types of investor, including one they called "Meme Stock Guy."

From that Reddit post: "The whole post seemed padded out to get to the one punchline of making the meme stock investor look like a neckbeard loser."

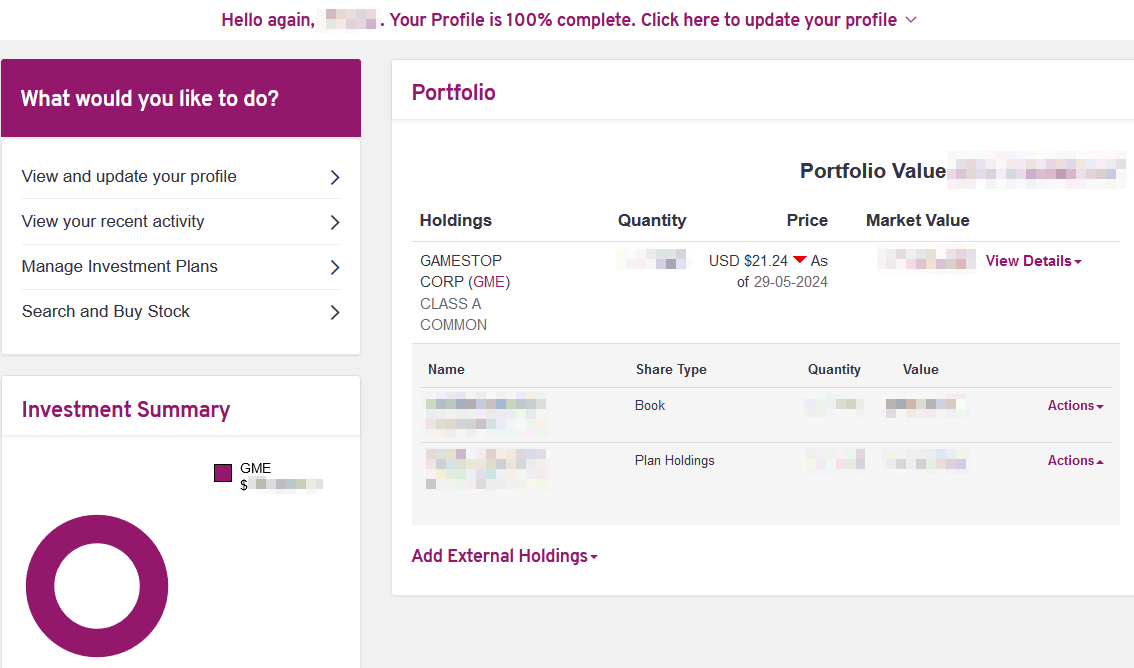

The purple circle is a symbol that was used exclusively by GME investors, primarily on Superstonk, which represents holding shares directly through DRS. When a shareholder holds shares with Computershare, which is GameStop's transfer agent, then Computershare provides a pie chart representing the value of holdings of stock within the Computershare account. In the case of many GME shareholders that directly registered their shares and hold in DRS with access from Computershare, the only registered stock that they have is GME, and thus the pie chart only has one color. Computershare uses purple for the color of the first listed stock, so the entire circle is filled purple. If an investor had GME as well as some other stock directly registered with Computershare, then their pie chart would show a purple area and an orange area, and more colors if there were more registered shares of other stocks.

This post by Fidelity demonstrates Fidelity's awareness of a purple circle in relationship to the term "meme stock," without mentioning GME or GameStop.

As major owners of Reddit, and as a major stock broker that received many requests from GME shareholders to directly register their shares of GME that were held in Fidelity accounts, Fidelity was indisputably keenly aware that this DRS movement was happening on Superstonk among GME investors. Fidelity had and has great insight into the metrics of DRS requests, and demographic information from the accounts that had submitted requests to DRS their shares of GME.

Thus, Fidelity produced a disparaging characterization of GME shareholders based on the insight that they had about GME shareholders on Superstonk, and called it Meme Stock Guy, demonstrating awareness and contempt of GME shareholders.

Fidelity deleted the post several hours after posting it.

Another term that is sometimes used by GME critics in a way similar to how "meme stocks" is used is the term "cult stocks," or similar terms such as "cultist" to refer to investors of "cult stocks."

The label "cult stock" functions as a dismissive rhetorical frame similar to "meme stock," but with an added insinuation that investors are not merely enthusiastic but also irrational, dogmatic, and blinded by group loyalty. By invoking the notion of a cult, the term implies that any bullish view is inherently delusional and therefore unworthy of serious consideration.

This framing delegitimizes both the investment thesis and the investors themselves, allowing critics to dismiss the possibility that the stock might have rational, fundamentals-based support.

For example, Slate.com published an article on October 10, 2024, titled "Can't Stop Meme Stock," which referred to content on Superstonk as "one of the closest experiences you can find to reading missives from a cult," and that "more recently, though, the cultists are back in force."

A YouTube video from September 2024 titled "The GameStop Cult: An Untold Story" describes how GME investors in places like Superstonk are in a conspiratorial echo chamber displaying cult-like dynamics such as unwavering faith despite failed predictions. The video presents a view of GME which highlights weak fundamentals, leadership concerns, unclear strategy, and the lack of demonstrated business turnaround. The narrative provided by the video fails to address any possible merits of the GME bull case, generally concluding that since GME investors do not have a valid investment thesis, they are therefore necessarily delusional cultists. This type of biased narrative would generally be considered by some GME investors to be an example of FUD.

Another YouTube video from August 2025 titled "Top 7 Signs You're in a Cult Stock | WallStreetBets" describes the properties of "cult stocks" without specifically mentioning GME verbally, though GME is shown in the video and the author's pinned comment at the top of the video reads: "What cult stocks are you bagholding? I still have 1 share of GME for fun."