GameStop Fiscal Year 2024 Earnings Results: Increasing Profitability and Value

Despite store closures and reduced revenue, GameStop shows improved profitability and the highest equity valuation in its history

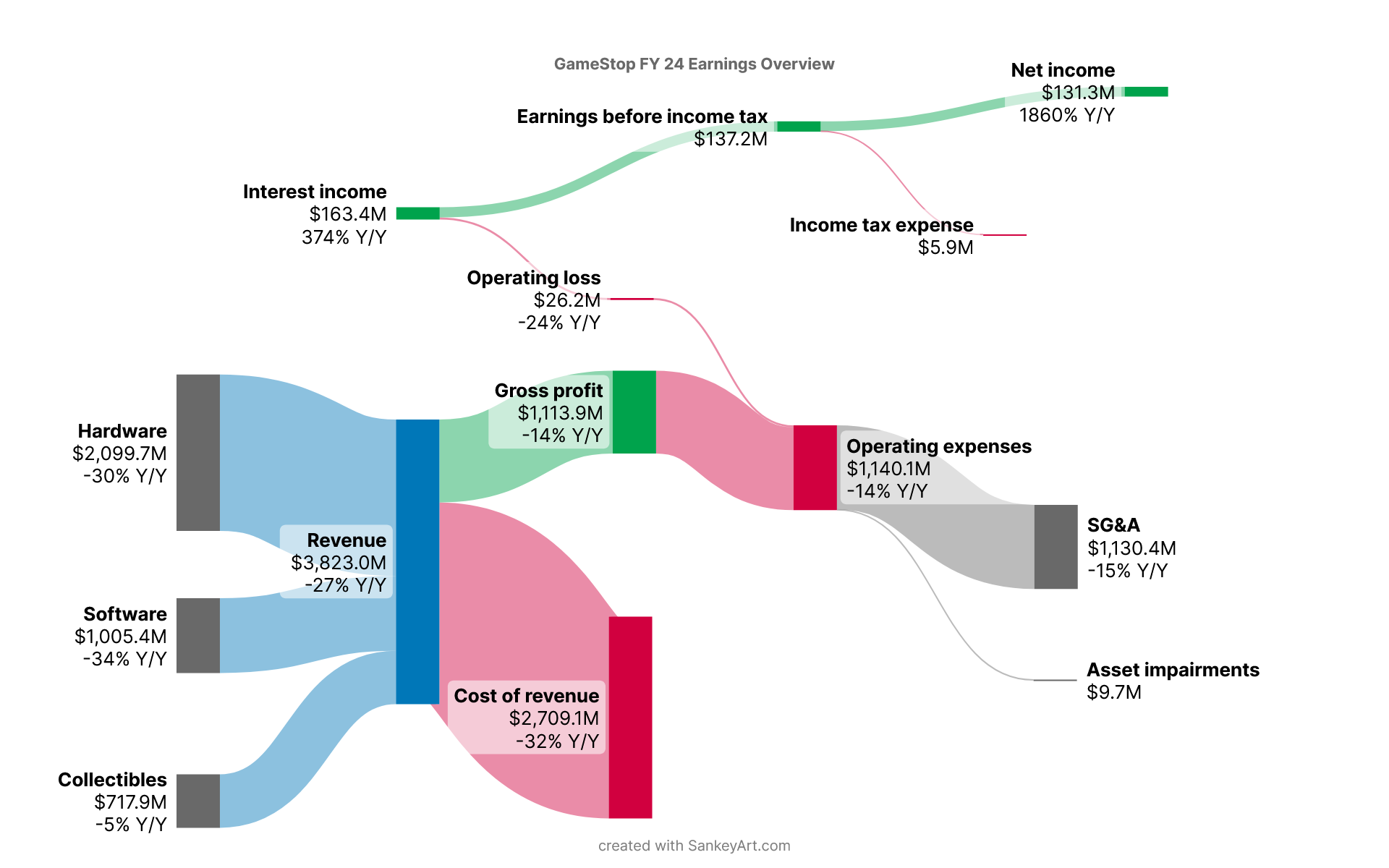

- GameStop reported a net income of $131 million, demonstrating a year-over-year increase of more than 1800% in bottom-line profitability.

- GameStop's legacy business continues to shrink: the company is closing more stores, and revenue is down 27% year over year.

- GameStop has introduced new product and service offerings for graded trading cards, demonstrating efforts to evolve the business.

- In terms of stockholders' equity, GameStop is now more valuable than at any point in the company's history, at nearly $5 billion.

GameStop's revenue continues to decline as its legacy business shrinks.

Accordingly, GameStop has reduced its store count every year since FY 16, a trend that has continued through the last four years of the company’s turnaround.

Numerous factors contribute to the decline of GameStop’s legacy business. Notably, gamers are increasingly spending more on digital video game products and services over the internet, rather than on physical products at brick-and-mortar retail stores such as GameStop. Furthermore, like all businesses, GameStop is also contending with inflation and broader economic headwinds.

With respect to retail operations, we plan to continue reducing costs and focusing on profitability ... This means a smaller network of stores with an expanded assortment of higher value items that fit into our trade-in model.

While GameStop has been improving the e-commerce side of its business, this has not yet resulted in significant revenue growth.

The company is demonstrating efforts to evolve its operations, for example by offering new products and services in graded trading cards. The graded trading card market is large and growing, presenting an opportunity for GameStop to increase its revenue.

GameStop continues to report operating losses. While the company has reduced these losses over the past five years, this indicates that the core business is still not profitable.

In 2024 (as in 2021), GameStop raised capital by selling shares at relatively high market prices and now holds over $4.7 billion in cash and equivalents. These funds are used for business operations and to generate interest income.

In fiscal year 2024, GameStop earned over $160 million in interest income. This income exceeded its operating and other losses, resulting in strong net profitability for the company.

In fiscal year 2023, GameStop showed a return to net profitability for the first time in 6 years.

Through 2024, GameStop strengthened its financial position by closing stores, reducing liabilities, and raising cash.

As a result, the company significantly improved its net income year over year and now reports its highest net profitability since fiscal year 2016.

By raising money from the market, GameStop now has the largest value of assets that it has had in its history, as well as the lowest amount of liabilities over the last 20 years.

In terms of stockholders’ equity, GameStop is now more valuable than at any other time in its history, with equity nearing $5 billion.

GameStop has been undergoing a turnaround and transformation since the current leadership team took over in 2021, and we are now starting to see clear, positive results from these efforts.

Adapting to the modern video gaming era, GameStop's legacy business of brick-and-mortar retail stores continues to shrink each year, with fewer locations and reduced revenue. Despite this, the legacy business is steadily being improved and modernized.

Beyond its legacy operations, the company has strategically leveraged stock market conditions by raising capital through share offerings at opportune times. With this substantial position of cash and equivalents, GameStop now generates enough interest income to offset operational losses, and more.

While it remains unclear to what extent GameStop's legacy business will continue to shrink, it is clear that GameStop's financial position is strong enough to manage this situation while generating growing profits.

Following its FY24 earnings release on March 25, GameStop made significant changes to its Investment Policy. The company raised over $4 billion from private offerings of convertible senior notes, and used some of that money to purchase bitcoin.